Life insurance is a cornerstone of financial planning. For many, it’s a way to ensure that their loved ones are protected financially when they’re no longer around. But one of the biggest concerns people have is finding affordable life insurance—coverage that fits their budget without sacrificing essential benefits.

If you’re searching for affordable life insurance, you’re not alone. Many individuals want to secure their family’s future but worry about the cost. Fortunately, affordable life insurance options exist, and with the right approach, you can find a policy that offers the protection you need at a price you can afford.

In this detailed guide, we’ll walk you through how to find the best affordable life insurance, break down different policy types, share practical tips for reducing premiums, and answer common questions. By the end, you’ll be equipped to make an informed decision and find affordable life insurance that works for you.

Key Takeaways

- Affordable life insurance is achievable through informed choices and planning.

- Term life insurance is usually the most cost-effective option for coverage.

- Assess your financial needs realistically before purchasing coverage.

- Shop around and compare quotes from multiple insurers.

- Maintain good health to secure lower premiums.

- Avoid unnecessary riders and over-insuring.

- Purchase early to lock in better rates.

- Review your policy periodically to ensure continued affordability and adequacy.

What is Affordable Life Insurance?

Affordable life insurance is simply life insurance coverage that fits your financial situation while providing sufficient protection for your loved ones. It’s not about finding the cheapest policy but about balancing cost and coverage wisely.

Many people mistakenly believe that life insurance has to be expensive to offer real value. However, affordable life insurance policies are designed to meet the needs of everyday families, singles, and individuals across various income levels.

Affordable life insurance policies typically come in the form of term life insurance, which offers coverage for a set number of years at low premiums. These policies can be tailored to your unique needs and budget, ensuring you don’t overpay for coverage you don’t require.

Understanding Life Insurance

Before diving into how to find affordable life insurance, it’s crucial to understand what life insurance is and why it matters. Life insurance is a contract between you and an insurance company. You pay premiums regularly, and in return, the insurer promises to pay a death benefit to your beneficiaries if you pass away during the policy term.

Life insurance serves multiple purposes:

- Providing income replacement for your family.

- Paying off debts and mortgages.

- Covering funeral and medical expenses.

- Supporting your children’s education.

- Leaving a financial legacy.

The Purpose of Life Insurance

The primary goal of life insurance is to replace lost income and provide financial security for your dependents. Whether you are the primary breadwinner or a caregiver, your absence can create a financial void that life insurance helps fill.

Life insurance can be used for various purposes, including:

- Income Replacement: Ensuring your family can meet living expenses without your income.

- Debt Coverage: Paying off loans, mortgages, credit cards, and other debts.

- Education Funding: Providing for your children’s future schooling costs.

- Final Expenses: Covering funeral and medical bills.

- Legacy Planning: Leaving a financial inheritance or charitable donation.

Finding affordable life insurance helps you secure these benefits without placing financial strain on your budget.

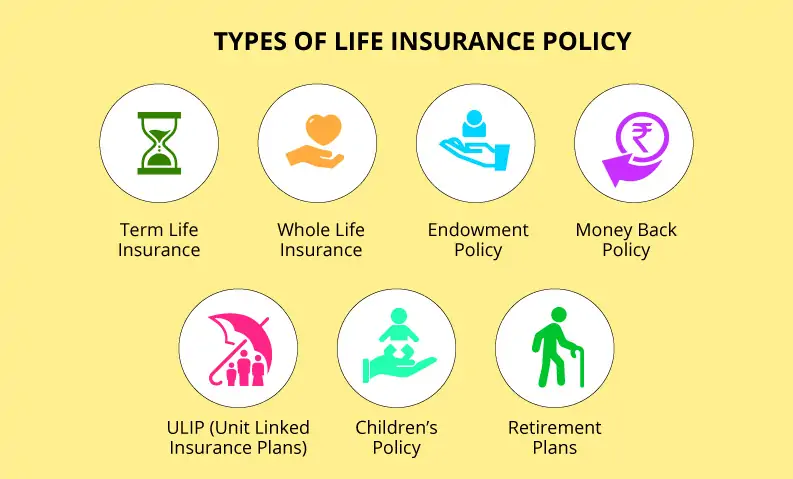

Types of Life Insurance Policies

When exploring affordable life insurance options, understanding the different types of life insurance policies is crucial. Life insurance comes in several varieties, each with unique features, benefits, and price points. Choosing the right policy type directly impacts how affordable your life insurance will be and how well it meets your financial goals.

The two primary categories of life insurance are Term Life Insurance and Permanent Life Insurance. Within these, there are variations designed to offer flexibility and additional benefits. Below, we break down each major type and highlight their relationship to affordability.

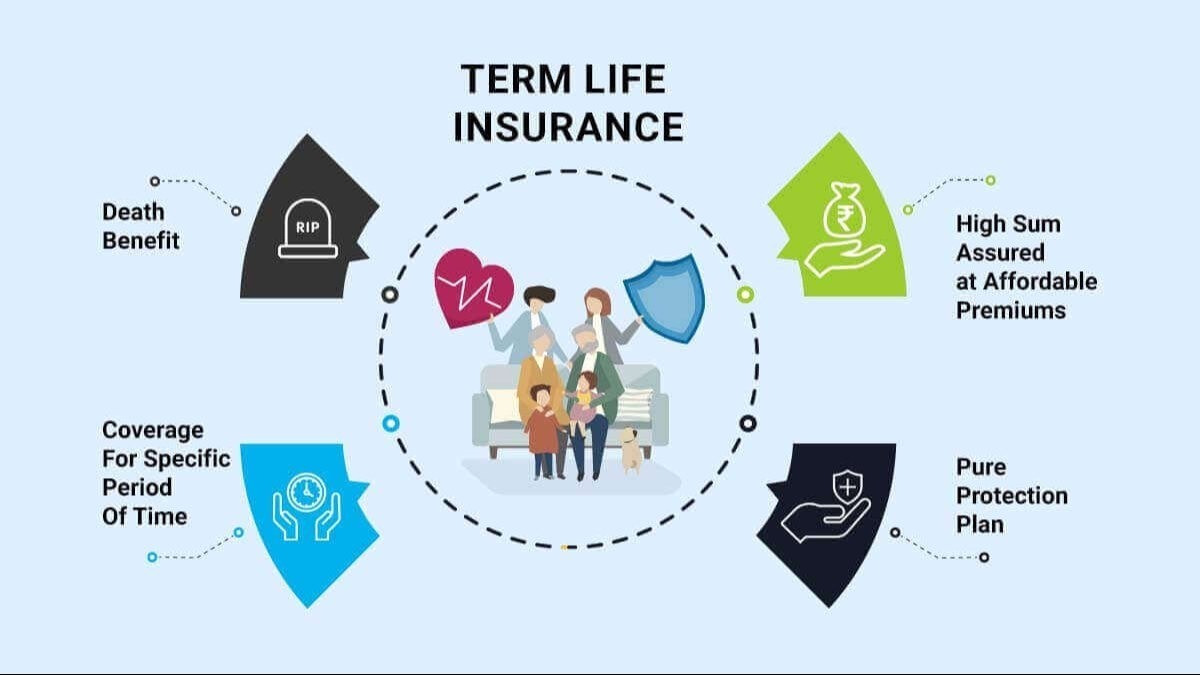

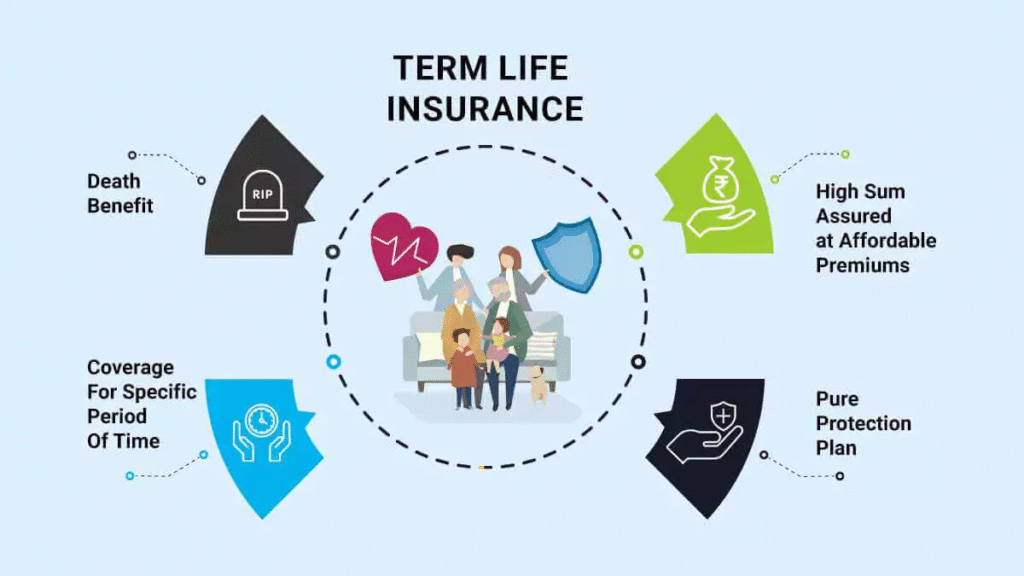

Term Life Insurance: The Most Affordable Option

Term life insurance is often the first choice for those seeking affordable life insurance. This policy provides coverage for a specific time frame—commonly 10, 15, 20, or 30 years—and pays a death benefit only if the insured passes away during the term.

Why Term Life Insurance Is Affordable:

- It doesn’t accumulate cash value, so premiums are lower.

- It covers a fixed term, usually aligned with your financial obligations, like raising children or paying off a mortgage.

- Since there’s no payout if you outlive the term, insurers can charge lower premiums.

Who Should Choose Term Life Insurance?

- Young families needing income replacement for a set period.

- Individuals seeking high coverage with limited budgets.

- People who want affordable life insurance while debts or financial responsibilities exist.

Pros of Term Life Insurance:

- Lower initial premiums.

- Simple and straightforward coverage.

- Flexible term lengths to match needs.

Cons:

- Coverage expires at the end of the term.

- No cash value or savings component.

Term life insurance is widely regarded as the most accessible form of affordable life insurance because of its simplicity and cost-effectiveness.

Whole Life Insurance: Permanent Coverage with Higher Costs

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and builds cash value over time. Premiums tend to be higher than term life insurance because of this added investment component.

Features of Whole Life Insurance:

- Fixed premiums that don’t increase with age.

- Guaranteed death benefit.

- Cash value grows at a guaranteed rate and can be borrowed against.

Why Whole Life Insurance Is Less Affordable:

- Higher premiums to fund both insurance and savings components.

- More complex policy structure.

Who Might Consider Whole Life Insurance?

- Those looking for lifelong coverage and an investment component.

- People interested in leaving a financial legacy or estate planning.

- Individuals who can afford higher premiums.

While whole life insurance offers comprehensive benefits, it is generally less suitable for those whose priority is affordable life insurance.

Universal Life Insurance: Flexible Permanent Coverage

Universal life insurance is another form of permanent life insurance with flexible premiums and adjustable death benefits. It combines protection with a cash value account that earns interest.

Key Features:

- Flexibility to increase or decrease premiums within limits.

- Ability to adjust the death benefit.

- Cash value grows based on current interest rates.

Cost and Affordability:

- Premiums can vary depending on interest rates and policy performance.

- Usually more expensive than term life but potentially more affordable than whole life, depending on usage.

Who Benefits from Universal Life Insurance?

- Policyholders who want permanent coverage with premium flexibility.

- Those interested in building cash value but want control over costs.

Universal life insurance can sometimes be tailored to be more affordable, but it generally doesn’t compete with term life for low-cost coverage.

Variable Life Insurance: Investment-Linked Permanent Coverage

Variable life insurance allows policyholders to invest the cash value in various investment options such as stocks and bonds, which can affect the policy’s performance.

Features:

- Potential for higher cash value growth.

- Policyholder controls investments within the policy.

- Death benefit may vary based on investment results.

Cost Considerations:

- Premiums tend to be high.

- Risks of cash value fluctuation.

- More suitable for those seeking both insurance and investment opportunities.

Because of its complexity and higher costs, variable life insurance is rarely the choice for affordable life insurance seekers.

Simplified Issue and Guaranteed Issue Life Insurance: Affordable Options for Some

If you have health issues or want quick coverage, simplified issue or guaranteed issue life insurance policies may be options. They typically require little or no medical underwriting, making them easier to qualify for.

- Simplified Issue: Some health questions but no medical exam.

- Guaranteed Issue: No health questions; guaranteed acceptance.

Affordability Aspects:

- Premiums are generally higher than term life due to increased risk for insurers.

- Lower coverage amounts.

- Useful as affordable life insurance for people who might otherwise be denied.

Final Thoughts on Types of Life Insurance and Affordability

For those prioritizing affordable life insurance, term life insurance overwhelmingly remains the best option due to its low cost and straightforward protection. Permanent policies, while offering lifelong coverage and additional features, tend to be significantly more expensive.

When choosing your life insurance type, weigh your budget, your need for lifelong coverage versus temporary protection, and whether you want investment features or simplicity. Consulting with an insurance advisor can help you navigate these options to find the best affordable life insurance suited to your situation.

Why Affordable Life Insurance Matters

Life insurance shouldn’t be a luxury reserved for the wealthy. Everyone deserves to have financial protection for their family, and affordable life insurance makes that possible. The key is balancing cost with coverage. Buying a cheap policy with insufficient coverage won’t help your family much, but paying for more insurance than you need can strain your budget.

| Reason Affordable Life Insurance Matters | Explanation |

|---|---|

| Financial Protection for Loved Ones | Affordable life insurance ensures your family can maintain their lifestyle and cover expenses if you pass away unexpectedly. |

| Peace of Mind | Knowing you have affordable life insurance provides reassurance that your loved ones won’t face financial hardship. |

| Debt and Mortgage Coverage | Helps pay off debts like mortgages, loans, or credit cards, preventing your family from inheriting these burdens. |

| Supports Future Expenses | Affordable life insurance can cover important future costs such as children’s education or weddings. |

| Accessible to More People | Affordable options make life insurance attainable even for those on tight budgets or variable incomes. |

| Avoids Financial Stress During Hard Times | It lessens the financial burden on your family during emotional and difficult periods. |

| Encourages Early Purchase | Affordable premiums encourage people to buy coverage earlier, locking in lower rates. |

| Flexibility in Coverage Options | Affordable life insurance policies often come with customizable terms that fit different financial situations. |

| Reduces the Risk of Being Uninsured | Makes it more likely people will have coverage, reducing the number of families left vulnerable without any insurance. |

| Promotes Responsible Financial Planning | Helps individuals incorporate life insurance into their overall budget and long-term financial strategy. |

How to Find the Best Affordable Life Insurance

Assess Your Insurance Needs

The first step is to evaluate how much coverage you need. Consider your financial obligations, such as:

- Outstanding debts (mortgage, car loans, credit cards).

- Income replacement for your family.

- Future expenses like college tuition.

- Funeral costs.

- Emergency funds.

Calculate a realistic coverage amount based on these factors. Many experts recommend a policy worth 10-15 times your annual income, but this varies based on your personal circumstances.

Compare Different Insurance Providers

Not all insurance companies offer the same rates or policies. It’s essential to shop around and compare quotes from multiple insurers. Use online comparison tools, work with an independent insurance agent, or consult financial advisors to gather multiple quotes.

Different companies assess risk differently, so you may find significant price variations for the same coverage.

Choose the Right Policy Type

As discussed earlier, term life insurance is generally the most affordable option. Decide on the policy term that aligns with your financial goals — for example, a 20-year term if you want coverage until your children are independent or your mortgage is paid off.

If you want lifelong coverage and investment benefits, permanent insurance might be suitable but expect higher premiums.

Maintain Good Health

Insurance premiums are based partly on your health and lifestyle. Maintaining a healthy weight, not smoking, managing chronic conditions, and avoiding risky behaviors can lower your insurance rates. Some insurers offer discounted rates to applicants who demonstrate a healthy lifestyle.

Understand Policy Features and Riders

Look for features or add-ons (riders) that might add value without substantially increasing premiums. For example, some policies offer critical illness riders or waiver of premium riders. However, avoid unnecessary riders that increase cost without providing real benefits.

Avoid Over-Insuring or Under-Insuring

Getting affordable life insurance means finding a balance — enough coverage to protect your loved ones but not so much that premiums are unaffordable. Use online calculators or consult with insurance professionals to strike this balance.

Lock in Your Rate Early

Your age, health, and lifestyle impact insurance rates. Getting insured while you’re younger and healthier can save you money over the long term. If you wait until you’re older or develop health issues, affordable life insurance becomes harder to obtain.

Review Your Policy Periodically

Your life circumstances change over time — marriage, children, career changes, or financial milestones. Review and adjust your life insurance to ensure it remains affordable and adequate.

Tips for Lowering Your Life Insurance Premiums

Finding affordable life insurance is about more than just comparing quotes. Here are some proven strategies to reduce your premiums:

- Buy Term Insurance: Choose term over permanent insurance if affordability is your goal.

- Opt for a Longer Term: Longer-term policies usually offer lower average annual premiums.

- Improve Your Health: Quit smoking, reduce alcohol intake, and maintain a healthy lifestyle.

- Consider Group Life Insurance: Employer-provided life insurance or membership-based policies can be more affordable.

- Avoid Tobacco: Smokers pay significantly higher premiums.

- Buy a Smaller Amount: Ensure your coverage meets your needs without excess.

- Pay Annually: Annual payments are often cheaper than monthly installment plans.

Common Misconceptions About Affordable Life Insurance

Many people misunderstand life insurance costs. Some think all life insurance is expensive or only for older adults. Others believe that insurance companies will reject them because of minor health issues. These myths keep people from securing affordable life insurance that could protect their families.

In reality:

- Term life insurance is very affordable for young, healthy people.

- Insurance companies evaluate risk on a case-by-case basis.

- You can still find affordable life insurance with pre-existing conditions by working with specialized insurers.

Also Read : What Are the Key Benefits of Having Insurance?

Conclusion

Finding the best affordable life insurance requires careful planning, research, and an understanding of your needs. Life insurance is not a one-size-fits-all product. By evaluating your financial situation, comparing multiple providers, choosing the right policy type, and maintaining good health, you can secure affordable life insurance that protects your family without straining your budget.

Remember, the cost of not having life insurance can be devastating for your loved ones. Affordable life insurance ensures they are protected, providing financial security when they need it most.

Start your search early, be informed, and make smart choices to find the best affordable life insurance policy for your unique situation.

FAQs

What is the best age to buy affordable life insurance?

Buying life insurance at a younger age, typically in your 20s or 30s, helps you lock in the lowest premiums. Insurers view younger applicants as lower risk.

How much affordable life insurance coverage do I need?

Coverage should ideally cover your financial obligations and income replacement for your dependents. Many experts recommend 10 to 15 times your annual income as a guideline.

Can I get affordable life insurance if I have a medical condition?

Yes. While certain conditions might increase premiums, many insurers offer policies tailored to individuals with health issues. It helps to compare multiple providers.

What’s the difference between term and permanent life insurance?

Term insurance covers you for a specified period and is generally more affordable. Permanent insurance covers you for life and includes a savings component but costs more.

Can I buy affordable life insurance online?

Yes, many insurers and brokers offer online quotes and applications, making it easier to compare and purchase policies quickly.

Does lifestyle affect my life insurance premiums?

Absolutely. Factors like smoking, drinking, and weight significantly impact your premium. A healthier lifestyle usually means lower costs.

Should I work with an insurance agent to find affordable life insurance?

An independent insurance agent can help you navigate the options, compare multiple companies, and find affordable life insurance tailored to your needs.