starting or expanding a business often requires capital, and for many entrepreneurs, securing that capital means applying for a business loan. However, the process can feel daunting, filled with paperwork, stringent requirements, and long waits. What if you could find a business loan easy to obtain, without the typical hassle? This guide will walk you through exactly how you can get a business loan the easy way — helping you save time, avoid stress, and increase your chances of approval.

Key Takeaways

- Defining your business needs simplifies the loan selection process, making it easier to get the right loan quickly.

- Maintaining a good credit score and organized financial documents accelerates approval.

- Online lenders and fintech platforms are excellent resources for obtaining a business loan easy with minimal fuss.

- Exploring alternative financing methods can provide faster access to capital.

- Building relationships with lenders and considering government-backed loans can open doors to easier approval.

- Staying informed about different loan types helps you make decisions that keep the process smooth and straightforward.

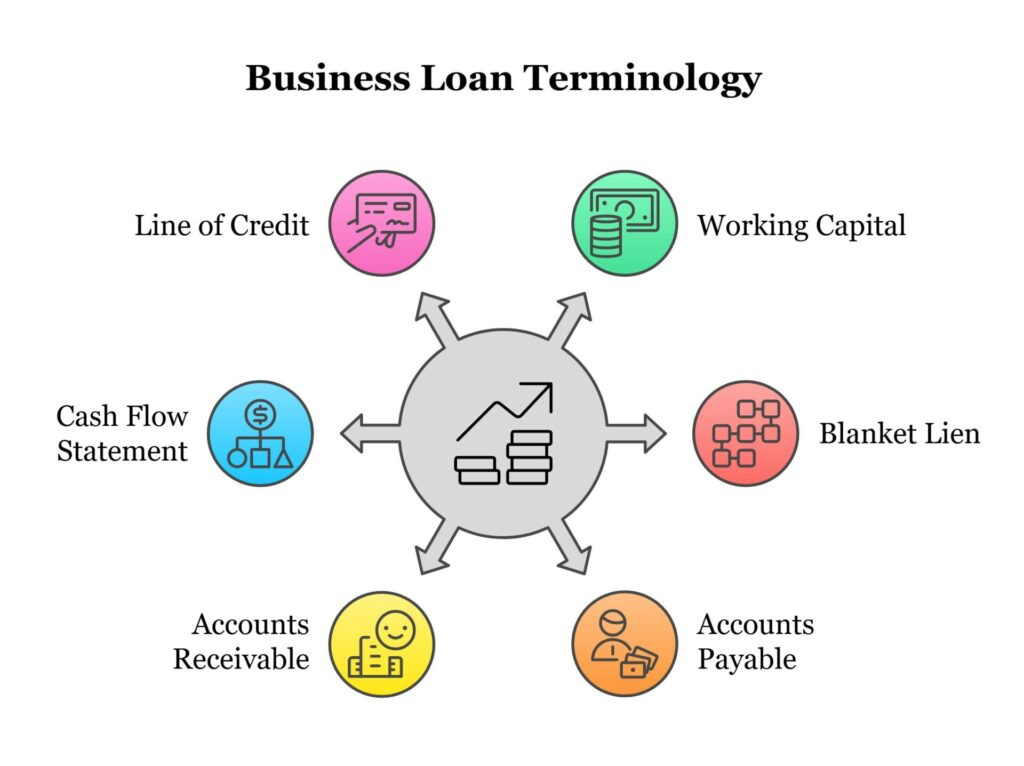

Understanding Business Loans

When it comes to funding your business, whether you’re starting up or scaling operations, a business loan is one of the most common and effective financial tools available. To make the process of securing a business loan easy, it’s crucial to understand what these loans are, how they work, and the types available to entrepreneurs and small business owners.

What Is a Business Loan?

A business loan is a sum of money borrowed by a company or entrepreneur from a lender, typically a bank, credit union, or online financing institution. The borrower agrees to repay the loan amount (known as the principal) along with interest over a specified period of time. Business loans can be used for a wide range of purposes, including:

- Launching a startup

- Expanding operations

- Purchasing inventory or equipment

- Hiring staff

- Managing cash flow

- Covering short-term expenses

In essence, a business loan provides working capital that can drive growth and sustain day-to-day operations.

How Business Loans Work

The process begins with an application. Lenders evaluate several factors before approving a loan, including credit score, business history, revenue, debt levels, and the intended use of the funds. Once approved, funds are disbursed, and repayment typically begins within a few weeks or months, depending on the agreement.

Most business loans are structured with:

- Principal: The original loan amount.

- Interest rate: The cost of borrowing, expressed as a percentage.

- Term: The time period over which the loan must be repaid.

- Repayment schedule: Monthly, bi-weekly, or even daily payments depending on the lender and loan type.

Making timely repayments not only ensures you avoid penalties but also builds your creditworthiness, making future applications for a business loan easy.

Why Business Loans Are Important

Access to capital can be the difference between success and stagnation. With the right funding, businesses can seize growth opportunities, withstand downturns, or simply operate more efficiently. A business loan is not just about money — it’s a tool for strategic investment in your business’s future.

However, many entrepreneurs find the process intimidating, which is why understanding the basics is the first step toward making the path to a business loan easy and straightforward.

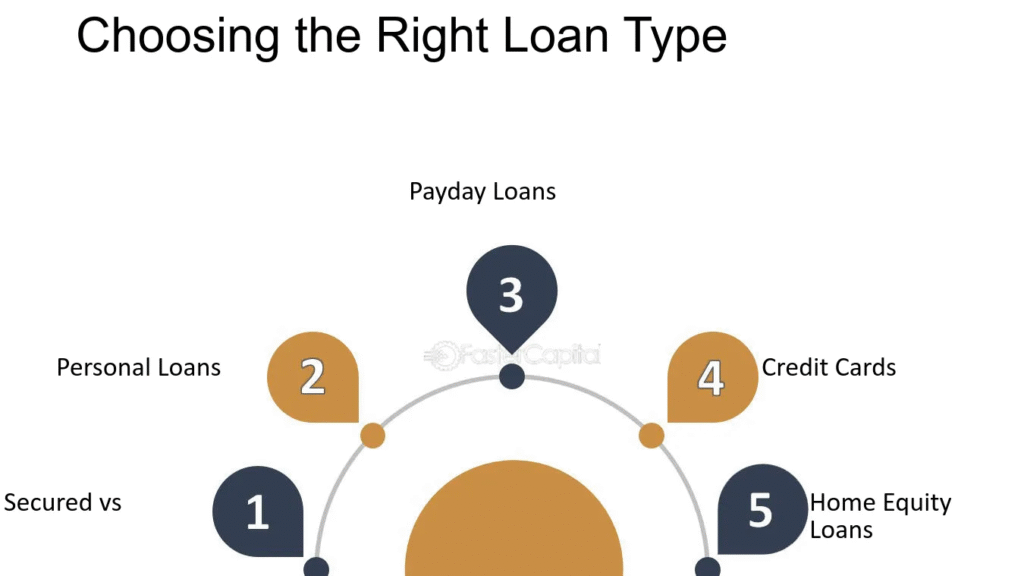

Types of Business Loans

Choosing the right type of business loan is critical to your success. The loan you select should align with your business needs, your cash flow, and your growth strategy. Understanding the different types of business loans is one of the first steps in making the process of securing a business loan easy and effective.

Each loan type comes with its own qualifications, terms, and benefits — and the right one can give you the capital you need with minimal friction.

Term Loans

Term loans are one of the most common forms of business financing. They involve borrowing a lump sum of money and repaying it in regular installments — typically monthly — over a set period.

Key Features:

- Fixed or variable interest rates

- Repayment periods range from 1 to 10 years

- Often used for equipment, expansion, or remodeling

If you’re well-established and have predictable income, a term loan might make getting a business loan easy and straightforward.

SBA Loans (Small Business Administration Loans)

SBA loans are partially guaranteed by the government, which reduces risk for lenders and enables them to offer favorable terms. These are ideal for small businesses looking for low-interest, long-term financing.

Types of SBA Loans:

- 7(a) Loan Program: Flexible funding for most business purposes.

- 504 Loan Program: For purchasing fixed assets like real estate or machinery.

- Microloans: Smaller loans (up to $50,000) for startups or small-scale needs.

While the application process can be thorough, SBA loans are known for making a business loan easy in terms of cost and terms once approved.

Business Lines of Credit

A business line of credit gives you flexible access to funds, similar to a credit card. You draw only what you need and pay interest only on what you use.

Benefits:

- Revolving credit — reuse after repayment

- Great for managing cash flow gaps

- Often easier to qualify for than large term loans

For businesses that need ongoing, flexible access to working capital, this option can make a business loan easy to manage over time.

Equipment Financing

Need new machinery, computers, or vehicles? Equipment financing allows you to borrow money specifically to purchase or lease equipment.

Why It’s Popular:

- The equipment itself acts as collateral

- Fixed interest rates and predictable payments

- Faster approval compared to other loan types

If your business relies heavily on tools or machinery, this type of business loan easy to obtain with minimal financial documentation.

Invoice Financing (Accounts Receivable Financing)

With invoice financing, you borrow money against your outstanding invoices. This improves cash flow without waiting for customers to pay.

Ideal For:

- B2B businesses with slow-paying clients

- Seasonal businesses with delayed receivables

- Companies needing quick liquidity

It’s a fast and accessible way to make a business loan easy, especially if you don’t want to take on traditional debt.

Merchant Cash Advances

A merchant cash advance (MCA) provides a lump sum of money that you repay from future credit card sales. Instead of a fixed monthly payment, repayment is based on your daily sales volume.

Pros:

- Fast approval — often within 24 hours

- No need for high credit scores

- Minimal paperwork

However, MCAs can be expensive. While they may make getting a business loan easy, it’s important to consider the total cost and impact on cash flow.

Microloans

Microloans are small loans — usually under $50,000 — aimed at startups, sole proprietors, and small businesses that may not qualify for traditional loans.

Offered By:

- Nonprofits

- Community lenders

- Government programs (like SBA microloans)

They make the business loan easy for those just starting out, especially when large amounts of capital aren’t needed.

Startup Loans

Startup loans are specifically designed for businesses with little to no operating history. While harder to secure from traditional lenders, many alternative lenders, crowdfunding platforms, and government programs offer startup funding.

Options Include:

- Personal loans used for business

- SBA microloans

- Online startup lenders

- Grants or local government-backed funds

These are tailored to make a business loan easy for entrepreneurs with big ideas but little background.

Commercial Real Estate Loans

If your business is buying, refinancing, or developing property, a commercial real estate loan is the appropriate financing vehicle.

Features:

- Longer repayment terms (10–25 years)

- Larger loan amounts

- Often secured by the property itself

These loans can be more complex, but for stable businesses, they can be a business loan easy to obtain with the right documentation and cash flow.

Franchise Loans

Franchise loans are designed for entrepreneurs looking to purchase and operate a franchise. Many lenders offer pre-approved loans for major franchise brands.

Benefits:

- Easier qualification due to brand name recognition

- Funding for franchise fees, equipment, and working capital

- Lower perceived risk for lenders

These loans streamline the approval process, making them a business loan easy route for new franchisees.

Which Type Is Right for You?

Choosing the right type of loan depends on several factors:

- Your business size and age

- Your credit score

- How quickly you need funding

- What you’ll use the funds for

- Your ability to repay

When you match your needs with the right type of loan, you make the process of getting a business loan easy, efficient, and tailored to your business goals.

Who Can Qualify for a Business Loan?

While qualifications vary by lender and loan type, common criteria include:

- A minimum time in business (often 6 months to 2 years)

- A solid credit score (though some lenders work with low-credit borrowers)

- Demonstrated revenue or cash flow

- A well-defined business plan

- Collateral (in some cases)

New businesses may face more hurdles, but by seeking out lenders with flexible requirements, the path to a business loan easy becomes more accessible.

Interest Rates and Fees

Understanding the cost of borrowing is essential. Business loan interest rates vary widely — from 3% for SBA loans to over 20% for merchant cash advances. In addition to interest, watch for:

- Origination fees

- Application fees

- Prepayment penalties

- Late payment charges

The key to making a business loan easy is comparing offers carefully, reading terms, and asking questions before you sign any agreement.

Secured vs. Unsecured Loans

Business loans can be either:

- Secured: Requires collateral such as property, equipment, or receivables. These typically offer lower rates but carry higher risk if you default.

- Unsecured: No collateral required. Easier to access but often comes with higher interest rates.

Understanding the difference helps you choose what suits your comfort level and risk tolerance.

Traditional vs. Online Lenders

Today, businesses have more options than ever:

- Traditional lenders: Offer stability and lower rates but are often slower and stricter with qualifications.

- Online lenders: Streamlined application processes, faster funding, and flexible terms. A go-to option if you’re looking for a business loan easy.

Final Thoughts on Understanding Business Loans

Navigating the world of business financing may seem complex at first, but with the right knowledge, it’s far from impossible. By understanding how business loans work, what types exist, and what lenders look for, you’ll be equipped to approach the application process confidently.

And when you’re informed, organized, and strategic — the path to a business loan easy isn’t just possible, it’s within reach.

Why Getting a Business Loan is Often Complicated

The traditional route of getting a business loan through banks is typically rigorous. Banks require extensive documentation like financial statements, credit history, business plans, collateral, and proof of consistent revenue. This process can be intimidating, especially for small or new businesses.

But here’s the good news: there are ways to make getting a business loan easy without compromising on the amount or terms you need.

How Can You Get a Business Loan the Easy Way?

Know Your Business Needs Clearly

The first step to obtaining a business loan easy is to be crystal clear about how much money you need and why. Defining your purpose — whether it’s buying inventory, upgrading equipment, or marketing — helps you choose the right loan product, saving time and confusion.

Improve Your Creditworthiness

Lenders want to see responsible borrowing behavior. This means having a good credit score both personally and for your business. If your credit is less than ideal, consider steps like paying down debts or correcting errors on your credit report before applying. Improving your credit can make the process of getting a business loan easy and faster.

Explore Online Lenders and Fintech Options

One of the biggest game-changers in making a business loan easy is the rise of online lenders and fintech platforms. These lenders often offer faster application processes, less paperwork, and quicker funding times compared to traditional banks. Many provide prequalification tools that let you check your loan options without impacting your credit score.

Prepare Your Documentation in Advance

While online lenders are more lenient, having your documents ready can speed up approval. Typical documents include:

- Business financial statements

- Bank statements

- Tax returns

- Identification proof

- Business licenses

Organizing these documents beforehand helps you avoid delays and gives a more business loan easy experience.

Consider Alternative Financing Options

If traditional loans seem daunting, look into alternatives that might be easier to secure, such as:

- Microloans

- Invoice financing

- Merchant cash advances

- Business credit cards

These alternatives often have simpler qualification requirements and can be a source of quick funding.

Use a Loan Broker or Advisor

Loan brokers specialize in helping businesses find the right lenders and packages. They can navigate the options and requirements on your behalf, often making the path to a business loan easy and less stressful.

Opt for Short-Term Loans or Lines of Credit

Short-term loans and business lines of credit tend to have faster approval processes due to their smaller amounts or flexible repayment terms. These options are ideal if you need quick cash and want to keep the loan process easy.

Maintain Clear and Consistent Cash Flow

A key factor lenders look at is your cash flow — consistent positive cash flow shows you can repay the loan easily. Having strong bookkeeping and accounting practices ensures you can demonstrate this effectively during your application.

Build Relationships with Your Lenders

If you already have a bank or financial institution you work with, leverage that relationship. Existing customers with positive histories may find it easier to get approved for a business loan easy due to established trust.

Apply for Government-Backed Loans

Government programs often have lower requirements or special terms for small businesses. Programs like the SBA (Small Business Administration) loans in the U.S. provide loan guarantees that make it easier for lenders to approve loans, helping you get a business loan easy.

Common Types of Business Loans to Consider

- Term Loans: Fixed amount with regular repayments over a set period.

- SBA Loans: Government-backed loans with competitive rates.

- Equipment Financing: Loans specifically for purchasing business equipment.

- Business Lines of Credit: Flexible borrowing up to a set limit.

- Invoice Financing: Borrow against unpaid invoices.

- Microloans: Small loans for startups or small businesses.

Choosing the right type influences how easy the process will be, so research which fits your needs best.

Also Read : Is Online Loan Approval Right for You?

Conclusion

Getting a business loan easy is entirely possible with the right approach and knowledge. The key lies in preparation, choosing the right lender, and understanding your business’s unique needs. By improving your credit, leveraging fintech innovations, considering alternative loans, and maintaining good financial habits, you can secure funding without the traditional headaches.

Whether you’re a startup or an established business, the path to obtaining a business loan easy is becoming clearer every day thanks to evolving financial technologies and diverse lending options.

FAQs

Q1: What does “business loan easy” really mean?

It means obtaining a business loan with minimal hassle, faster approval, fewer documentation requirements, and accessible qualification criteria.

Q2: Can I get a business loan easy without perfect credit?

Yes. Some lenders and alternative financing options cater to businesses with less-than-perfect credit, though terms may vary.

Q3: How long does it take to get a business loan easy?

With online lenders or fintech platforms, approvals can happen within 24-72 hours, compared to weeks with traditional banks.

Q4: What documents do I need for a business loan easy application?

Typically, basic documents like tax returns, financial statements, bank statements, and identification are required, but online lenders may ask for less.

Q5: Are online business loans safe and reliable?

Many online lenders are reputable, but always research and verify lender credentials before sharing sensitive information.

Q6: Can new businesses get a business loan easy?

Yes, though they may qualify better for microloans, startup-specific loans, or alternative financing.

Q7: How much can I borrow with an easy business loan?

Loan amounts vary widely based on lender, business size, and purpose, from a few thousand dollars to several million.