In today’s uncertain world, securing your future and protecting what matters most has become an essential part of financial planning. Whether it’s your health, property, business, or family’s well-being, insurance plays a pivotal role in providing peace of mind and safeguarding against unforeseen events. Understanding the benefits can help you make informed decisions that protect you and your loved ones from financial setbacks.

Insurance is a contract that transfers risk from an individual or entity to an insurance company, which, in return for a premium, promises to compensate for losses covered under the policy. But the value goes beyond mere financial protection; it provides stability, security, and a host of other advantages that often go unnoticed. This article explores the multifaceted benefits, detailing how can serve as a cornerstone for personal and economic resilience.

Key Takeaways

- It is provides essential financial protection against unexpected events, reducing the risk of severe monetary losses.

- Peace of mind from insurance benefits allows individuals and businesses to focus on recovery and growth.

- Insurance encourages disciplined savings and long-term financial planning, particularly through life insurance policies with cash value.

- Businesses rely on insurance benefits to manage risks, ensure continuity, and foster economic stability.

- Health insurance improves access to medical care, leading to better health outcomes and lower overall costs.

- it plays a critical role in social stability by distributing risk and supporting economic development.

- Customizing the policies enhances the value of benefits tailored to individual needs.

- Understanding and utilizing benefits is a strategic approach to securing your future and managing financial uncertainty.

The Essence of Insurance

At its core, insurance is a powerful tool designed to manage risk and provide protection against financial uncertainty. Life is inherently unpredictable, filled with unexpected events that can cause substantial economic hardship. These might include health emergencies, accidents, property damage, or even the loss of a loved one. The essence of insurance lies in its ability to absorb these shocks and provide a safety net that protects individuals, families, and businesses from bearing the full burden of loss.

It operates on the principle of risk pooling. Many policyholders contribute premiums to a common fund managed by an company. When an insured event occurs, the company compensates the affected individual or entity from this pool. This collective sharing of risk means that no single person has to bear the entire cost of a loss alone. Instead, the financial impact is spread across a wider group, making it more manageable for everyone involved.

This risk-sharing mechanism is one of the most valuable benefits because it transforms individual uncertainty into a collective assurance. Rather than facing potentially devastating financial consequences alone, insured parties gain peace of mind knowing they have a safety net.

Moreover, ii’s provides not just protection, but also a foundation for stability and growth. With the certainty that comes from knowing risks are covered, individuals are empowered to make long-term financial decisions, invest in their futures, and take calculated risks. Businesses, in particular, rely on to protect assets, safeguard operations, and foster innovation without the constant fear of catastrophic loss.

Beyond the financial aspects embodies a social contract — a commitment to mutual support and resilience. It builds community strength by providing resources and relief in times of crisis, reducing the overall burden on individuals and society.

In summary, the essence of is its role as a risk management tool that provides financial protection, peace of mind, and stability. This fundamental purpose underpins the wide range of benefits available to policyholders and is central to why remains indispensable in personal and economic planning.

Financial Security and Peace of Mind

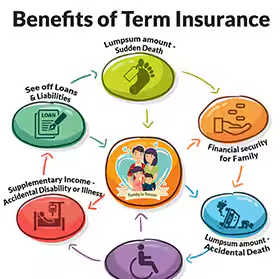

One of the most significant and universally appreciated benefits is the financial security it provides to individuals, families, and businesses. Life’s uncertainties—ranging from sudden illness and accidents to natural disasters and unforeseen death—can lead to enormous, often unmanageable expenses. Without insurance, these unexpected costs can drain savings, force asset liquidation, or push people into debt. it’s acts as a protective shield, absorbing these financial shocks and helping to stabilize your economic situation when life takes an unexpected turn.

Having insurance coverage means that you are not alone in facing the financial consequences of adverse events. For example, health insurance ensures that medical bills from hospital stays, surgeries, or routine treatments are covered, reducing the risk of medical debt. Similarly, property i can reimburse the cost of repairing or replacing a home damaged by fire, theft, or natural calamities. Life insurance can provide a financial lifeline to dependents, helping them maintain their living standards even after the loss of a breadwinner.

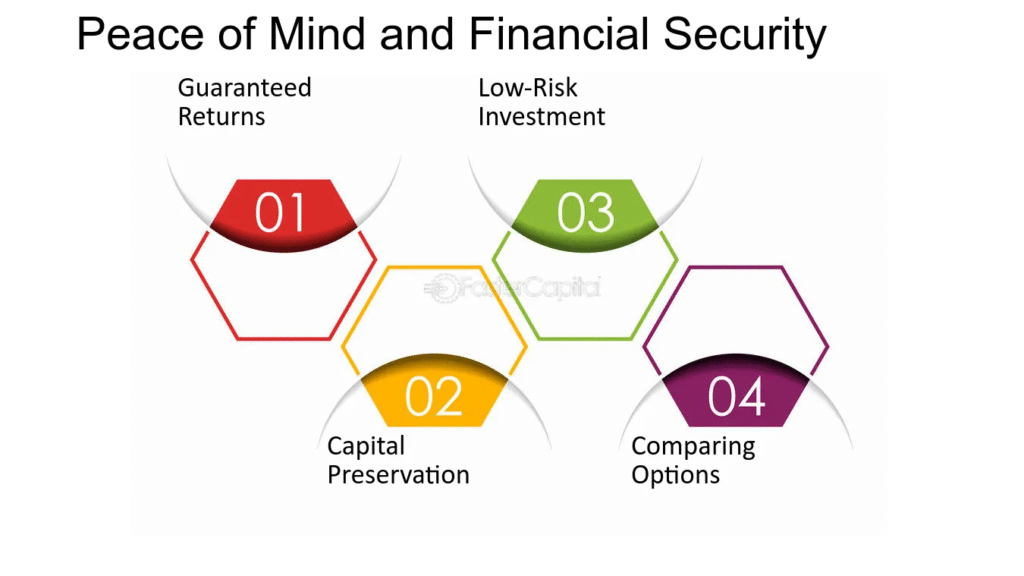

This financial security naturally leads to peace of mind, a priceless yet often overlooked benefit. When you know that you have adequate coverage, there’s less worry about what might happen if disaster strikes. This mental relief allows you to focus on recovery, healing, and moving forward instead of being overwhelmed by financial stress. Peace of mind encourages better decision-making and emotional resilience, especially during challenging times.

Moreover, peace of mind from insurance extends beyond just the individual policyholder. Families benefit immensely because they know that loved ones will be taken care of financially, even in worst-case scenarios. Businesses, too, gain confidence to pursue growth and innovation without being paralyzed by fears of loss or liability.

In essence, financial security and peace of mind are intertwined benefits that transform the way people manage risk. They provide a foundation of stability in an uncertain world, empowering you to live with confidence, knowing you have a reliable safety net behind you.

Protection Against Catastrophic Losses

Catastrophic losses, such as natural disasters, serious illnesses, or major accidents, can be financially crippling. One of the critical benefits is the protection it offers against such events. Property insurance, for example, safeguards homes and valuables against fire, theft, or weather damage. Health covers treatment costs, often including costly surgeries or chronic illness management.

This protection ensures that catastrophic losses don’t translate into permanent financial ruin. It allows individuals and businesses to recover and continue operations after significant setbacks.

| Type of Catastrophic Loss | Insurance Coverage | Key Insurance Benefits | Impact Without Insurance |

|---|---|---|---|

| Natural Disasters (e.g., floods, earthquakes, hurricanes) | Property Insurance (Homeowners, Flood, Earthquake) | Covers repair/replacement costs; financial recovery support | Complete financial loss; inability to rebuild or recover |

| Serious Illnesses (e.g., cancer, heart disease) | Health Insurance | Covers expensive treatments; access to advanced care | High out-of-pocket costs; possible debt or treatment delays |

| Fatal Accidents or Death | Life Insurance | Provides death benefits to family; replaces lost income | Financial hardship for dependents; loss of income security |

| Major Vehicle Accidents | Auto Insurance | Covers vehicle repair, medical bills, liability | Huge repair costs; potential legal liabilities |

| Business Interruption due to Fire or Disaster | Business Insurance (Property & Business Interruption) | Protects against income loss; covers operational costs | Business closure; loss of income; layoffs |

| Liability Claims (e.g., lawsuits, injuries) | Liability Insurance | Covers legal costs, settlements, and damages | Devastating legal expenses; potential bankruptcy |

Encourages Savings and Financial Discipline

Certain types of insurance, particularly life policies with savings components, also encourage disciplined savings. Policies like whole life or endowment provide not only protection but also an investment avenue where part of the premium accumulates as cash value.

These policies offer dual benefits — protection and forced savings. They can serve as a financial reservoir for future needs, retirement planning, or major life goals, making them a valuable tool in long-term financial planning.

Helps in Risk Management for Businesses

For businesses, insurance is vital in risk management. Companies face risks ranging from property damage to liability claims and employee injuries. By obtaining appropriate coverage, businesses transfer these risks to insurers.

This transfer of risk allows businesses to operate confidently, invest in growth, and protect their assets. The benefits for businesses include liability protection, employee compensation, business interruption coverage, and more, all of which ensure continuity and stability.

Facilitates Access to Credit and Loans

One of the often overlooked but highly valuable benefits is its role in facilitating access to credit and loans. In both personal finance and business, borrowing is a critical tool that enables growth, investment, and financial flexibility. However, lenders naturally face risks when they provide loans, especially if the borrower’s collateral or ability to repay might be compromised by unforeseen events. This is where insurance becomes an essential enabler.

When you apply for a loan—whether for a home, vehicle, education, or business expansion—lenders typically require insurance coverage on the asset being financed. For example, mortgage lenders require homeowners to have property . Similarly, auto loans usually come with a requirement for comprehensive car insurance. This requirement protects the lender’s interest by ensuring that the collateral retains its value or can be replaced in case of damage or loss.

Moreover, benefits extend to life policies. Many lenders accept a life insurance policy as collateral for a loan. This means that if the borrower passes away before repaying the loan, the insurance payout can be used to clear the outstanding debt, preventing financial hardship for the borrower’s family and reducing risk for the lender.

By reducing the lender’s risk, insurance makes it easier for borrowers to obtain loans at favorable interest rates and terms. It provides a safety net that reassures lenders, allowing them to extend credit with greater confidence. Without insurance, lenders might impose stricter conditions or higher interest rates to compensate for the added risk.

This relationship between insurance and credit markets creates a virtuous cycle: insurance benefits improve financial stability and creditworthiness, while access to credit allows individuals and businesses to invest, grow, and improve their economic standing. In this way, insurance not only protects assets but actively supports financial empowerment and economic mobility.

In summary, plays a pivotal role in unlocking financial opportunities by facilitating access to credit and loans. This benefit helps borrowers secure necessary funds with more ease, while lenders gain assurance that their investments are protected—ultimately fostering economic activity and personal financial growth.

Promotes Social Stability and Economic Growth

On a macro level, the benefits extend to promoting social stability and economic development. Insurance spreads financial risks across the population, reducing the economic impact of disasters on individuals and communities. This spreading of risk contributes to social welfare by protecting vulnerable groups.

Moreover, enables entrepreneurship by reducing risks associated with starting and running businesses. It stimulates economic activities, job creation, and innovation. Governments also rely on industries to stabilize markets and support recovery efforts post-disasters.

Health Benefits Through Access to Better Care

Health insurance specifically offers immense benefits by improving access to quality healthcare services. It reduces out-of-pocket medical expenses and encourages timely medical consultations and preventive care. Insured individuals are more likely to seek medical help early, leading to better health outcomes and reduced overall healthcare costs.

Many health insurance plans include wellness programs, health screenings, and chronic disease management, further enhancing the overall health and well-being of the insured population.

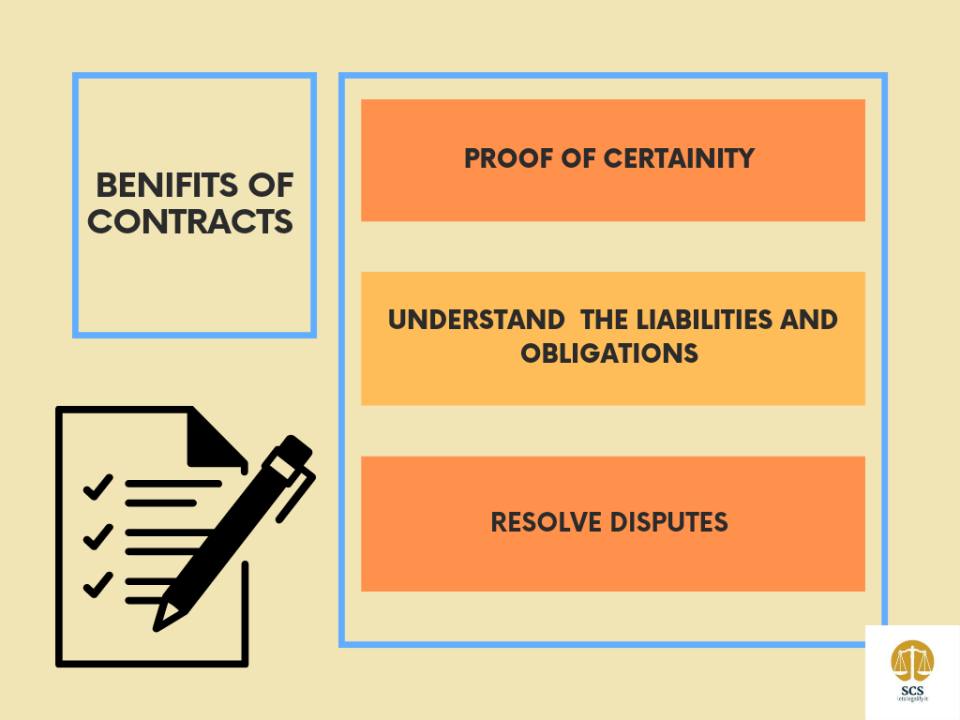

Legal and Contractual Benefits

It’s provides crucial insurance benefits that extend beyond financial protection, notably in fulfilling legal requirements and securing contractual obligations. In many cases, having insurance is not merely optional but mandatory—both by law and through contractual agreements—making it an indispensable aspect of responsible risk management.

Legal Requirements

Several types of insurance are legally mandated to protect public interest and maintain societal order. For instance, auto insurance is required by law in most countries to ensure that drivers can cover damages or injuries resulting from accidents. Similarly, employers are often legally required to carry workers’ compensation insurance to cover employee injuries sustained on the job. Health insurance mandates may exist to guarantee access to essential medical services, and in some jurisdictions, property is required for mortgage holders.

The benefits here are twofold: compliance with the law and protection against legal penalties. Failure to maintain mandatory insurance can result in fines, license suspension, or even legal action, besides leaving individuals or businesses exposed to potentially ruinous financial liabilities.

Contractual Obligations

Insurance is also a vital part of many contracts, especially in business and real estate. Lease agreements, loan contracts, and service contracts frequently require one or both parties to maintain certain types of coverage. For example, landlords often require tenants to have renter’s to protect against damage or liability within the rented premises. Construction contracts usually mandate builders’ risk to cover losses during the project.

Meeting these contractual requirements provides assurance to all involved parties that risks are managed and financial liabilities are covered. This fosters trust and smooth business relationships, minimizing disputes and protecting investments.

Risk Transfer and Legal Protection

Through liability policies—such as general liability, professional liability, or directors and officers individuals and businesses gain legal defense coverage. This aspect of benefits protects policyholders from the potentially crippling costs of legal claims and lawsuits. companies often provide legal representation and pay settlements or judgments on behalf of the insured.

Without such coverage, defending against claims could drain resources, distract from core activities, and even lead to bankruptcy. The legal protection afforded by thus enables greater confidence in undertaking activities that carry inherent risks.

Emotional and Psychological Support

While often overlooked, insurance offers emotional and psychological support during difficult times. The reassurance that comes from knowing you have financial backup can reduce stress and emotional strain in crisis situations. This mental resilience helps individuals and families cope better and make rational decisions during emergencies.

Summary of Key Insurance Benefits

To encapsulate, here are the primary insurance benefits:

- Financial protection against unexpected losses

- Peace of mind and reduced stress

- Protection from catastrophic financial setbacks

- Encouragement of savings and disciplined financial planning

- Risk management for businesses ensuring stability

- Facilitating access to credit and loans

- Contributing to social welfare and economic growth

- Improving access to healthcare and preventive services

- Meeting legal and contractual insurance requirements

- Providing emotional and psychological support in crises

Also Read : How Do Business Insurance Companies Protect Your Business?

Conclusion

It is a vital component of personal and economic security, offering a comprehensive range of benefits that extend far beyond mere financial compensation. The benefits include providing financial protection, encouraging savings, supporting businesses, facilitating credit, and contributing to social and economic stability. It enables individuals and organizations to manage risks effectively and focus on growth and well-being.

Understanding the breadth of these benefits can empower you to make informed decisions about your it needs. Whether you seek to protect your family’s future, your business, or your health, investing in appropriate insurance coverage is a prudent strategy for managing the uncertainties of life.

Ultimately, transforms unpredictable risks into manageable challenges, ensuring that setbacks don’t turn into catastrophes. By leveraging the power of , you safeguard your peace of mind, financial stability, and long-term prosperity.

FAQs

Q1: Why is insurance important even if I am healthy and financially stable?

Even if you are healthy and financially secure, insurance is essential because risks are unpredictable. Health can deteriorate suddenly, accidents can happen anytime, and natural disasters don’t discriminate. Insurance protects your assets and future earnings, ensuring you don’t face devastating financial losses in unforeseen circumstances.

Q2: How does insurance benefit small businesses specifically?

Small businesses benefit from insurance through protection against property damage, liability claims, employee injuries, and business interruptions. This protection helps maintain operations during crises and prevents financial collapse, which is critical for the survival and growth of small enterprises.

Q3: What is the difference between term life and whole life insurance regarding benefits?

Term life insurance provides pure protection for a specified period, offering death benefits but no cash value. Whole life insurance combines protection with a savings component that accumulates cash value over time. Both offer benefits, but whole life policies also act as investment and savings vehicles.

Q4: Can insurance benefits vary significantly by policy type and provider?

Yes, benefits differ based on the type of insurance (health, life, property, auto) and the policy terms set by providers. Coverage limits, exclusions, premium amounts, and claim procedures affect the nature and extent of benefits.

Q5: How do insurance benefits affect financial planning?

benefits play a critical role in financial planning by reducing uncertainty and potential financial setbacks. With adequate, individuals and families can allocate resources confidently to other goals such as education, retirement, or investments, knowing they are protected against major risks.

Q6: Are insurance benefits taxable?

Generally, benefits such as payouts and health reimbursements are not taxable, but this can vary depending on jurisdiction and specific policy terms. Consulting a tax advisor is recommended for clarity on individual circumstances.

Q7: Can I customize insurance policies to maximize benefits?

Most policies can be customized through riders and add-ons to enhance or extend coverage. Customization allows you to tailor benefits according to your unique needs, increasing the policy’s relevance and value.